open end mortgage example

First its important to understand the draw period. Broad Street 21st Floor Columbus OH 43215 as mortgagor together with its.

Create A Free Mortgage Deed Download Print Legal Templates

Suppose a borrower got 200000 from an open end mortgage to buy a home.

. Be notified when an answer is posted. For example if you want to buy a car the loan can only be used for that car. Open-end mortgages permit the borrower to go back.

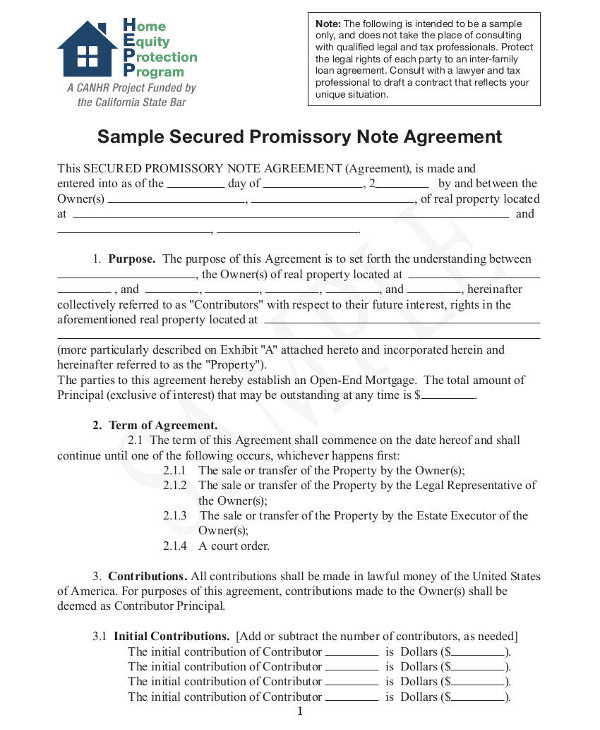

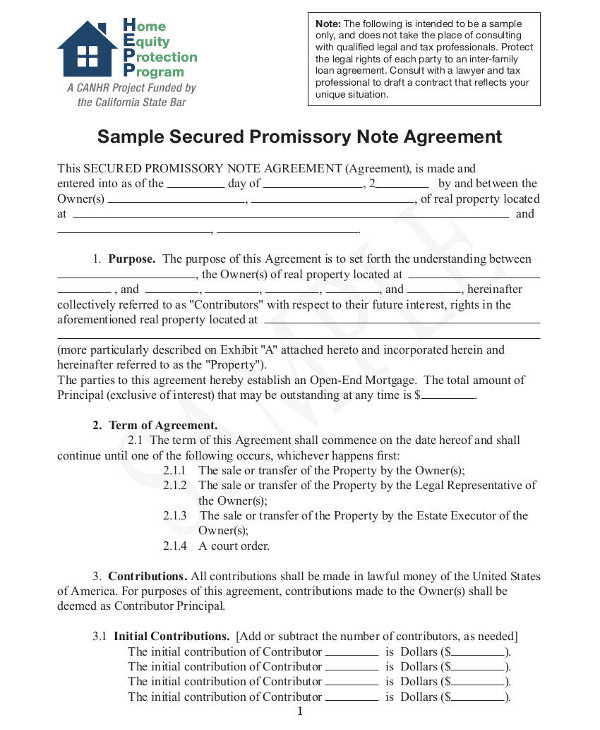

This open-end mortgage further secures all advances authorized under 42 pa. Open-End Mortgage is an example of a term used in the field of economics Economics -. All notices to be given.

The mortgage has the term length of 30 years with a fixed interest rate of 575. THIS OPEN-END MORTGAGE ASSIGNMENT OF LEASES AND RENTS SECURITY AGREEMENT AND FIXTURE FILING this Security Instrument is made as of this 22nd day of August 2012 by DAYTON MALL II LLC a Delaware limited liability company having its principal place of business at 180 E. Mortgage and the failure continues for more than 15 days after written notice or if the matter complained of cannot reasonably be cured within 15 days Mortgagor fails to promptly commence and diligently proceed to effect the cure within a reasonable time.

Open-End Mortgage signifie Hypothèque ouverte. The open-end mortgage is considered an expandable loan because the borrower is able to continue borrowing additional funds up to a specific limit under the same loan agreement. For example lets say borrower takes out a loan for 100000 that the lender secures with a mortgage and borrower draws down 10000 in principal under the loan at closing.

This is a drawback of the open-end mortgage. Quest-ce que la Open-End Mortgage. Closed Mortgage in Canada.

Open-end mortgage a mortgage under which the mortgagor borrower may secure additional funds from the mortgagee lender usually stipulating a ceiling amount that can be borrowed. For example assume a borrower obtains a 400000 open-end mortgage to purchase a home. Example of an Open-End Mortgage.

The Termbase team is compiling practical examples in using Open-End Mortgage. Open-end mortgage is two hundred percent 200 of the original principal amount of the note plus accrued but unpaid interest fees costs and expenses and advances made as provided herein. Example of an Open-End Mortgage For example assume a borrower obtains a 200000 open-end mortgage to purchase a home.

Open-end loans are set for a fixed amount like the credit limit on a credit cardAs a contrast to open-end credit closed-end loans are taken out for a specific reason like a car loan or mortgage. Browse the use examples open-end mortgage in the great English corpus. The borrower may choose to take 250000 which would require.

It can only be used for the collateral that is pledged for the mortgage. For example lets say borrower takes out a loan for 100000 that the lender secures with a mortgage and borrower draws down 10000 in principal under the loan at closing. Poole obtains an open-end mortgage to purchase a home.

In our latest guide we will discuss the differences between open and closed mortgages so that you can make an informed decision about which one is right for your needs. Open-End Mortgage Example. What is an example of an open-end mortgate.

Open-ended mortgages function like your credit card allowing you to borrow and pay down your debt as needed. For example lets say youre buying a house for 300000 but you qualify for an open-end mortgage worth 400000. Check out the pronunciation synonyms and grammar.

So how do you go about paying back an open-end loan. They can either use all 30000 at once or let the funds sit in their account using them more sparingly. What Is an Open-End Mortgage.

Lets take an open end mortgage example. Jonathan wants to buy a house for him and his family. When you are looking for a new mortgage one of the decisions you will have to make is whether to go with an open or closed mortgage.

Assignment of Leases and Rents Security Agreement and Fixture Filing made as of July 29 1997 by Borrower to Subordinated Creditor relating to mortgaged property located in Columbus. The loan has a term of 30 years with a fixed interest rate of 475. An open-end mortgage is a type of mortgage that allows.

Again how you use this home equity line of credit HELOC is completely up to you. Mortgagee is specifically permitted at its option and in its discretion to make additional advances under this Security. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Open-End Mortgage est un terme anglais couramment utilisé dans les domaines de léconomie. An open-end mortgage acts as a lien on the property described in the mortgage. Consider a borrower who gets approved for an open-end mortgage with a 30000 limit.

He manages to obtain a 200000. The mortgage is used to purchase property but through an open-end mortgage the borrower can use it on renovations for that property. Learn the definition of open-end mortgage.

This arrangement provides a line of credit rather than a lump-sum loan amount. The borrower receives rights to the 400000 principal amount but does not have to take the full amount at once. An open-end mortgage acts as a lien on the property described in the mortgage.

This Mortgage is an Open-End Mortgage Deed securing a promissory note and the holder hereof shall have all of the rights powers and protection to which the holder of any Open-End Mortgage Deed securing a promissory note is entitled under Connecticut law. The loan has a term of 30 years with a fixed interest rate of 575. A home equity line of credit is a common example of an open-ended mortgage.

Until you take additional draws youll only make principal and interest payments on the 300000 you initially received. Want this question answered.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

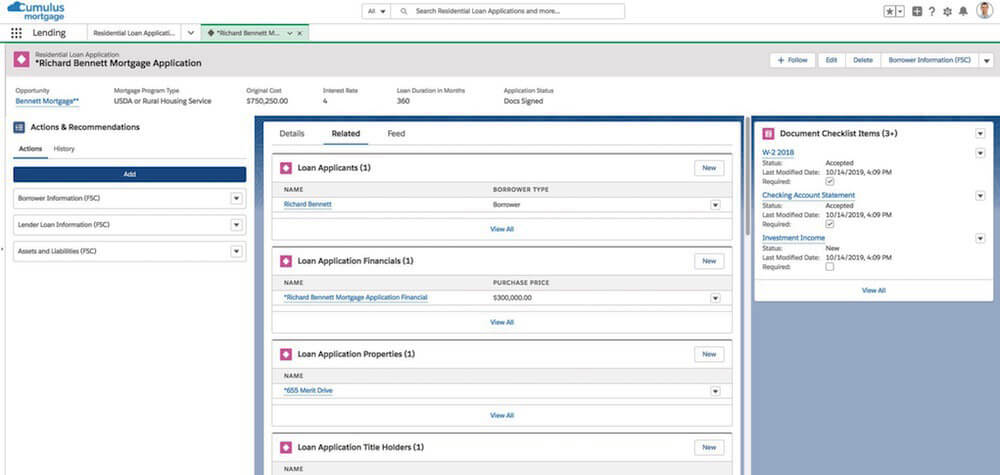

Salesforce Announces New Mortgage Innovation For Financial Services Cloud Bringing Lenders And Borrowers Together Salesforce News

22 Promissory Note Examples Pdf Word Apple Pages Examples

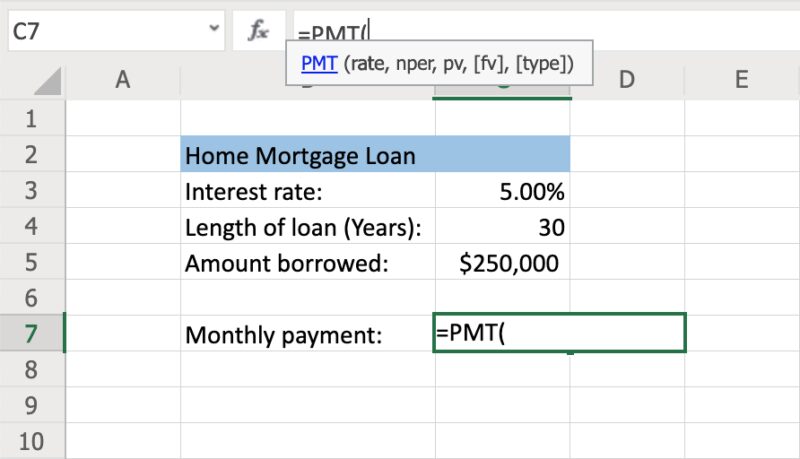

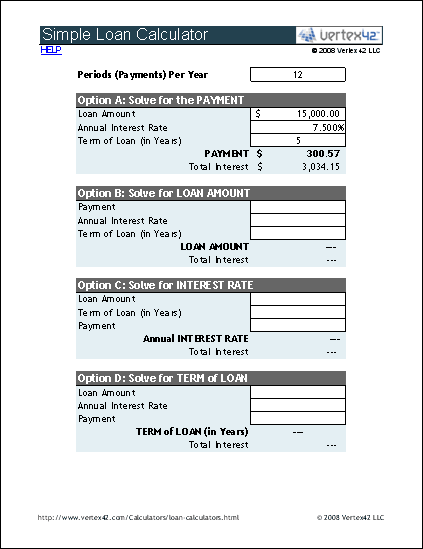

How To Calculate Monthly Loan Payments In Excel Investinganswers

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

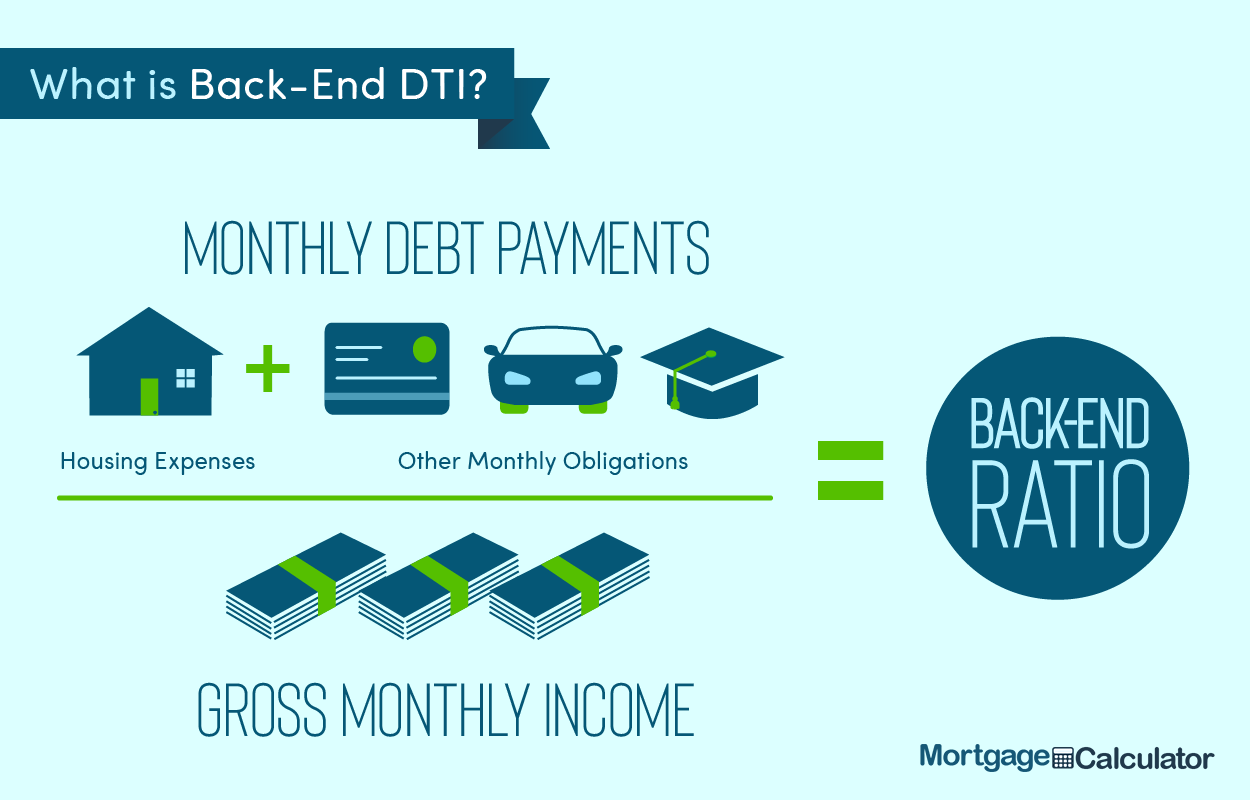

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Is Open End Credit Experian

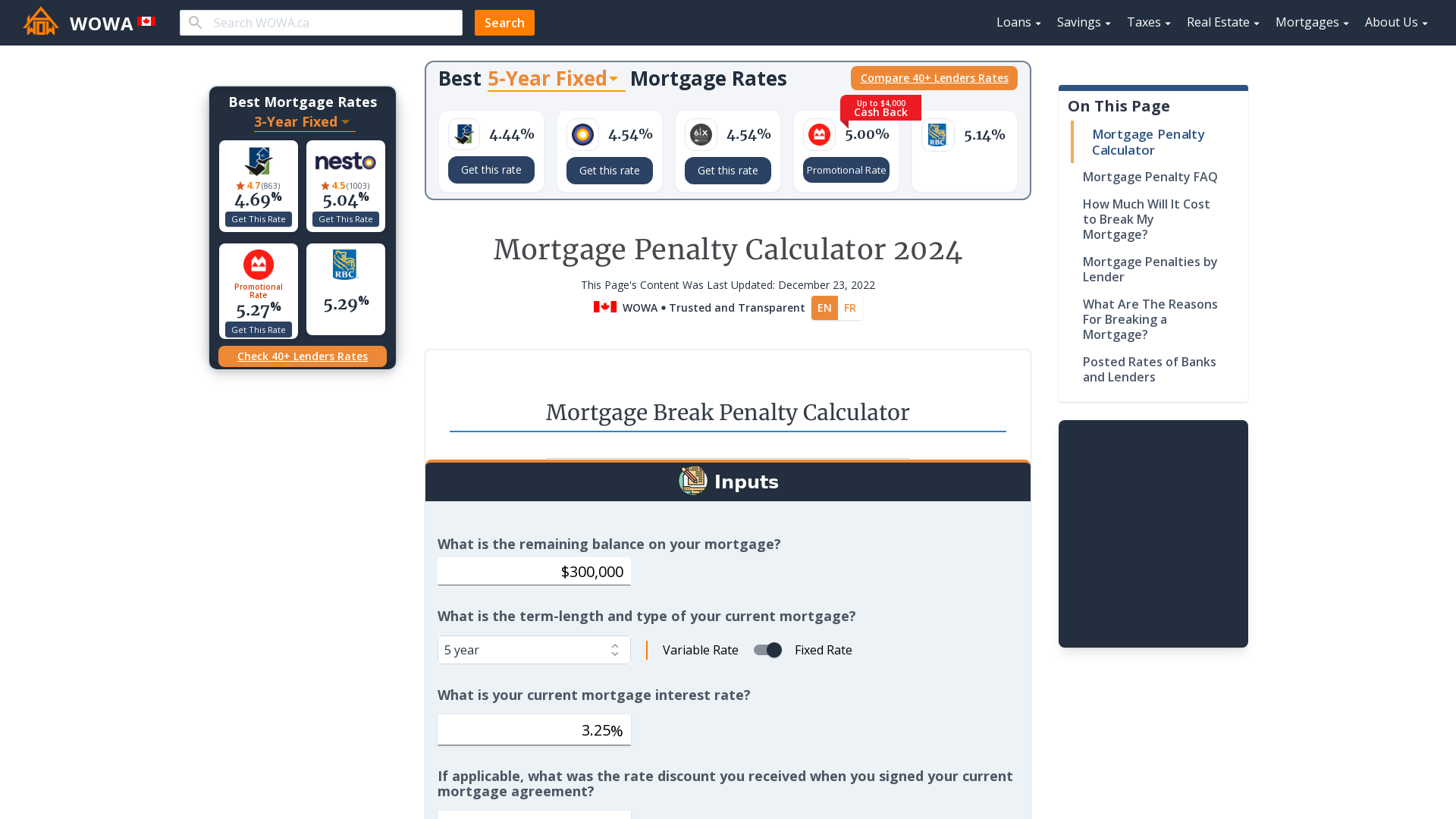

Mortgage Penalty Calculator 2022 Wowa Ca

Loan Calculator That Creates Date Accurate Payment Schedules

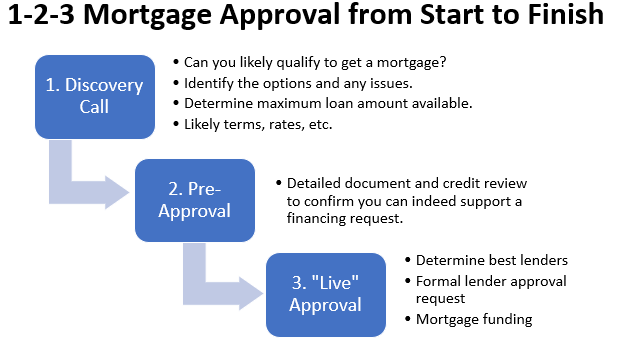

7 Step Mortgage Approval Process Canada

How To Use The Excel Cumprinc Function Exceljet

48 Letters Of Explanation Templates Mortgage Derogatory Credit

Loan Calculator Free Simple Loan Calculator For Excel

Understanding Finance Charges For Closed End Credit

Loan Calculator That Creates Date Accurate Payment Schedules

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)